*** MILITARY SITUATION ***

Ukrainian TVD, Day 58-64

The past week has seen Russian forces initiate an integrated offensive along the Siverskyi Donets Line & Severodonetsk Salient. Assaults resume against the Azovstal Metallurgical Zone; UKR forces execute several spoiling attacks. Russian forces will likely move SE from Barvinkove to Druzhkivka just south of Kramatorsk to cut the remaining GLOCs from the west and the north-south link to Avdiivka. The push north from Avdiivka is likely meant to link-up with Russian forces in the Kramatorsk.

Russia needs a battlefield success(es) for any hope of drawing out concessions from Ukraine. Severodonetsk must be taken to claim victory in Luhansk. Therefore, Russia will go hard for Severodonetsk and the Slovyansk-Kramatorsk area.

Odesa-Kherson OD

Oleksandrivka to the west of Kherson is reported to be under Russian control. Russian forces launch attacks in northern Kherson Oblast toward Kryvyi Rih. Ukrainian forces claim to have recaptured several towns along the M14 HWY toward Kherson. Physically, moving from the periphery inward is problematic as complex highway interchanges, road congestion, innumerable subterranean and surface passageway access makes controlling movement difficult without a massive engineering effort to reshape the city itself.

Mariupol

Russian forces renewed attacks against the Azovstal Metallurgical Zone over the weekend (23-24 April), most likely to secure the M14 HWY running through the industrial Zone. Operations also continue against pockets of resistance outside the Azovstal area. The siege of Mariupol illustrates how difficult it is for contemporary military forces to exert physical and/or virtual control of urban spaces. Virtually, cell phone saturation, social media, and cloud services render virtual isolation improbable. It is unlikely that Russian troops will storm Azovstal itself but will focus attacks on reducing the size of the defensive perimeter of the Steel Plant. There are indications that the north Azovstal may have been captured by Russian forces.

"Situation in Mariupol Azovstal growing more dire. Marine commander Serhiy Volyna says ~600 wounded troops in serious condition, w/o meds, in unsanitary conditions; 100s of civilians including many kids, people with disabilities underground. They’re running out of food and water."

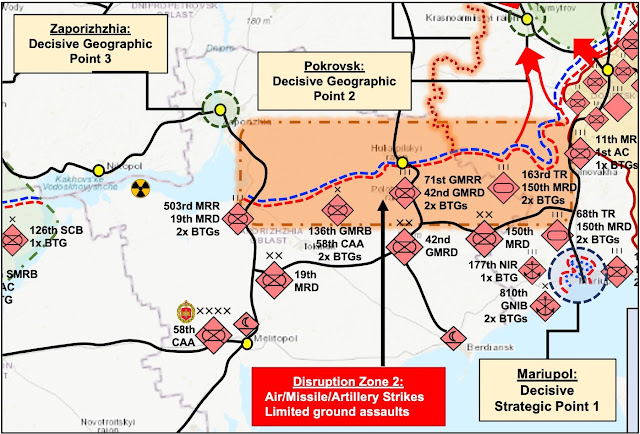

Zaporizhzhia OD

Russian forces have made numerous small gains over the last several days along the Ukrainian defensive line running from Vasylivka, through Huliaipole, to Velyka Novosilka. These attacks may potentially threaten Zaporizhzhia if a breakthrough is made. An assault on Zaporizhzhia, though not immediately likely, may well be an eventual action Russian forces will take. As the administrative center of the Zaporizhzhia Oblast it is an important political objective to hold to claim legitimacy of a propped-up proxy state. So far Russian actions in this area appear consistent with my earlier assessment of the Zaporizhzhia OD being a disruption zone where the intent is to fix Ukrainian forces to ensure success of operations in the Severodonetsk-Donestsk OD.

Severodonetsk-Donetsk OD

The Russians have expanded their initial limited probing / recon in force attacks of 19-22 April into a general dispersed offensive. Russian troops are pushing methodically on generally mutual supporting axes north and west of Slovyansk-Kramatorsk. In the Severodoentsk Salient it appears Russian forces are positioning to encircle the main urban sprawl of Severodonetsk-Lysychansk from the NE and SE while reducing Ukrainian defenses through massed artillery bombardment. Further south on the Donetsk-Horlivka region, expect Russian offensive action to continue in Marlinka & Avdiivka as Russian & proxy militia forces attempt to break through the Ukrainian prepared defenses along the line of contact.

Kharkiv OD

The Ukrainian General Staff estimates at least 7x BTGs of 6th CAA & Baltic / Northern Fleet Naval Infantry blocking Kharkiv and screening Russian movements east of the Siverskyi Donets. Ukrainian forces inch closer to Kozacha Lopan, threatening Russian control of the E105 HWY from Ruska Lozova to Belgorod. Russian loss of the E105 HWY will place Belgorod under increased threat of Ukrainian long-range strike attacks.

Six M777 155mm towed howitzers that Australia announced is sending to Ukraine already arrived at the Rzeszow-Jasionka Airport in southeastern Poland, delivered by C-17 transport aircraft.

-Russia intends to create a proxy state in the south, with a referendum planned in Kherson possibly in the first week of May. Ongoing partisan activity & civil resistance may prevent this from occurring. Recent Russian rhetoric suggests a resumption of the Norossiya project.

-There are an estimate 1,000 civilians in Azovstal, Russian forces continue to target Ukrainian civil & civic leaders throughout southern Ukraine for arrest to disrupt civil resistance to Russian occupation. Ukrainian partisan activity remains high.

-Russian forces made limited advances west of Severodonetsk but remain stalled south of Izyum. Ukrainian forces in eastern Ukraine are likely successfully conducting a maneuver defense rather than holding static positions, redeploying mechanized reserves to resist attempted Russian advances. Concentrated Russian artillery is enabling minor Russian advances, but Ukrainian positions remain strong. Limited Ukrainian counterattacks around Kharkiv city may additionally force Russian forces to redeploy units intended for the Izyum axis to hold these positions.

-There has been heavy fighting in the cities of Lysychansk and Severodonetsk, the ministry (Defence) said, with Russian troops attempting to advance south from Izyum in an apparent pincer movement aimed at encircling Ukrainian forces.

-VKS air sorties strike multiple railway hubs in western Ukraine with PGMs to slow the distribution of western military aid further east. PGM attacks also target Odesa. It is estimate Russia has expended 1,300 PGMs in Ukraine.

-A fighter pilot known as the Ghost of Kyiv died in an air battle last month after allegedly shooting down more than 40 Russian aircraft, it can be revealed. Major Stepan Tarabalka, 29, a father of one, was killed when the MiG-29 he was flying was shot down on March 13 while fighting “overwhelming” enemy forces, according to local reports.

-On April 25 the Russians targeted a host of railway hubs in western Ukraine in a systematic fashion. Five were hit within an hour in the morning and at least one more later on. The Russians did not target rail itself, but transformer substations that keep rail lines electrified.

The Russian military, using long-range precision weapons, destroyed six traction substations at the railway stations of Ukraine, “through which foreign weapons and military equipment are supplied to the Ukrainian group of troops in the Donbass.” This was announced on Monday by the representative of the Russian Ministry of Defense Igor Konashenkov. The echelons that transport goods for the Armed Forces of Ukraine are pulled mainly by electric locomotives, noted the military analyst Yuri Podolyaka. Therefore, the decommissioning of traction power plants is of great strategic importance. “If the Russian command continues to strike at Ukrainian substations, this could be a much more effective solution than hitting railway bridges,” Podolyaka said.

I am not so sure that de-electrifying Ukrainian lines is that valuable. De-electrification would mean that Ukraine would have to fall back on using diesel locomotives alone. And according to the Russian commentator Sergei Sigachev its fleet of diesel locomotives is rather small. (Apparently 1627 electric vs 301 diesel.) So if complete de-electrification could be achieved and maintained that would doubtlessly have serious consequences for Ukraine’s industry and economy. (The main users of rail.) However military trains are always going to be given highest priority so with 301 diesel engines around it might be entirely possible to keep moving military cargoes around without much fuss. It sounds like in order to interrupt high-priority transports the rail lines would have to be cut, not just de-electrified.

-POLITICO, in a surprising act of journalism, provides a gripping first hand account of what it is like to be on the receiving end of Russian artillery and aerial bombardment in the Donbass. It ain’t pretty:

Eighty miles north of the city, First Lt. Ivan Skuratovsky, serving in the 25th Airborne Brigade, told POLITICO that help needs to come immediately. “The situation is very bad, [Russian forces] are using scorched- earth tactics,” the 31-year-old married father of two said via text. “They simply destroy everything with artillery, shelling day and night,” he said via text. He fears that if reinforcements in the form of manpower and heavy weaponry — particularly air support — don’t arrive in the next few days, his troops could find themselves in the same position as those in Mariupol.

Skuratovsky described his soldiers’ situation as “very desperate.”

“I don’t know how much strength we will have,” he said, adding that the troops under his command around the city of Avdiivka, near Donetsk, have gone without rest since the start of the war. At least 13 of them have been wounded in recent weeks, he said, and they are running dangerously low on ammunition, reduced to rationing bullets. The day before, he told POLITICO his soldiers were being bombarded with Russian howitzers, mortars and multiple-launch rocket systems “at the same time.” Just hours earlier, he said, they had been attacked by two Su-25 warplanes, “and our day became hell.” Skuratovsky had a message for the United States and other NATO countries: “I would like to tell them that grenade launchers are good, but against airstrikes and heavy artillery we will not be able to hold out for long. People can no longer endure daily bombardments. We need air support now. We need drones.”

-Anders Åslund, a pro-Ukrainian reporter says Ukraine has experienced setbacks in the past few days. A senior Ukrainian official announced yesterday that Russian troops had taken part of the Kharkiv region. Yesterday, Russia announced that it has captured the entire Kherson region. No Ukrainian advances. "Russia is increasing the pace of offensive in Ukraine in all directions", – Speaker of the Ukrainian Defense Ministry Oleksandr Motuzyanyk. Apparently, even the Armed Forces of Ukraine are tired of the lulling lies of Arestovich.

-German reporter Julian Röpcke says yesterday's Ukrainian army statement reveals the frontline in Donetsk oblast is 15 km further N-W than I previously had it. Feel free to say, "this is old, we knew all this". Fact is, the Ukr general staff never acknowledged territorial losses N-W of Staromlynivka.